Each day, more Florida residents are turning to solar. The momentum of Amendment 1’s defeat continues to grow as Floridians are taking power into their own hands by harnessing solar power and its tremendous benefits. One of the great benefits Floridians can win with solar power is by taking advantage of the federal solar investment tax credit, also known as ITC.

The ITC: What is it?

The solar ITC is federal policy that allows for solar growth by granting tax credits to homeowners and businesses. Florida homeowners and businesses are eligible for a tax credit that may be applied when purchasing a solar system. Homeowners may implement the ITC to their personal income taxes upon a solar system’s purchase and install. Businesses may also use the ITC as a corporate tax credit when filing income taxes after a complete install.

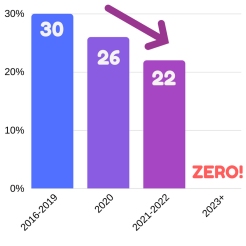

In 2015, the ITC was signed into law to be extended through 2023. However, as the graphs below illustrate, the eligible benefits for both homeowners and businesses decreases each year until 2023:

ITC Benefits for Homeowners

- 30% in 2016-2019

- 26% in 2020

- 22% in 2021-2022

- 0% in 2023+

ITC Benefits for Businesses

- 30% in 2016-2019

- 26% in 2020

- 22% in 2021-2022

- 10% in 2023+

How the ITC Works

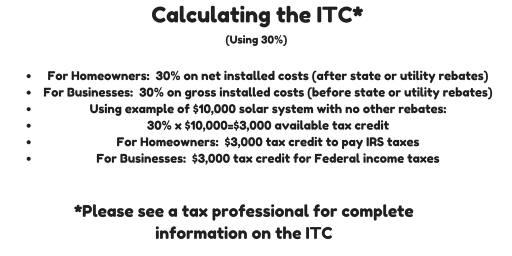

The ITC is a 30 percent tax credit of the “basis” that a person has invested in “eligible property” for solar systems on residential (under Section 25D) and commercial (under Section 48) properties and is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government (Source: Solar Energy Industries Association). The ITC is a tax credit, not an exemption or deduction. The ITC is also NOT a refund. The homeowner would fill out IRS forms 5695 and 1040 regarding the tax year of the system’s install and electricity generation (also known as “placed in service”). Homeowners may visit here for a more help.

How We Win with the Solar ITC

With the federal solar investment tax credit, everyone in solar wins. In addition to helping Florida homeowners and business owners reap the rewards of bankable solar, the ITC also helps advance industry growth and creation. The National Renewable Energy Laboratory (NREL) and The Solar Foundation have conducted exhaustive studies on solar’s impact in the job and economic sectors. According to The Solar Foundation’s report, Florida boasts over 6,500 employees directly involved in solar (click here for the full Florida pdf report). The NREL’s report differs slight from The Solar Foundation’s, as the NREL suggests that with the ITC between 2016 and 2022, employment in solar will be 32% higher and will have an economic impact of $39 billion.

Now is THE time!

The solar federal investment tax credit helps the economy by providing jobs as well as giving business and homeowners purchasing solar the ability to receive a tax credit. This policy decreases for homeowners from 30% now to ZERO for homeowners in 2023. Now is the time for Florida homeowners and businesses alike to go solar and apply for the ITC while tax credit rates are at their highest. With the solar investment tax credit, going solar in Florida is more bankable than ever. The ITC: one of the many great benefits of going solar!

Bay Area Solar Solutions aims to help Floridians take advantage of the ITC but please keep in mind we are solar experts, not tax experts, as we encourage you to consult a qualified tax agent for further understanding and filing.

Subscribe to our FREE Newsletter

Need more information on going green and ready to take the next step? We are here for you at Bay Area Solar Solutions LLC, where your solar needs come first!

Need more information on going green and ready to take the next step? We are here for you at Bay Area Solar Solutions LLC, where your solar needs come first!

4 thoughts on “You WIN with the Solar ITC!”